Explore the rise and challenges of Lay’s in the Indian market. Learn how PepsiCo’s strategic moves, including localized flavors and promotional campaigns, shaped Lay’s market position. Discover why Lay’s market share declined and how health concerns, value-for-money issues, and retailer margins influenced its brand image.

Beverage and foods major PepsiCo, the parent company of Lay’s, calls its journey of entering India “a Historical agreement” as when it entered India in 1988, the company had to go through a half-decade-long process of negotiations. So, after multiple rejections, the company entered Indian markets with its beverage product Pepsi, introduced in India as “Lehar Pepsi”. The company couldn’t attain a large market share in the initial years but did not give up on its operations. It employed various sales and marketing strategies to attract the targeted customer segment and achieve a larger market share. Later in around 1995, it introduced its famous snacking product “Lay’s” in India. When Lay’s entered the Indian markets, it faced fierce competition with Uncle Chipps as it was the leader of the potato chip industry with a market share of over 71% at the time.

In the coming years after the launch, Lay’s became the principal rival of ‘Uncle Chipps’ and the largest chip manufacturer in India. One of the reasons for the growth of Lay’s could be the various chip packet sizes varying from Rs. 5 to Rs. 25, which people thought was justified (compared with Uncle Chips at Rs. 7 per packet). Another reason for the success is generally attributed to the geographically tailored flavour, Magic Masala (Blue Lays). By 2000, Pepsico also acquired the company that produced Uncle Chips, Amrit Agro Ltd.

Company Offerings in India

With over 30+ years of existence and a very catchy tagline, “Betcha can’t eat Just one”, Lay’s is one of the most loved and best-selling potato chips in India. Currently, Lay’s offers various flavours in India, dividing them into different categories, like Regular – all-season flavours, Limited edition flavours, gourmet, wafer styled, wavy, etc., for defined targeted customer segments. It modified its offerings to match the local Indian flavours with India’s Magic masala as one of its signature masala-infused offerings. With a perfect infusion of tangy, spicy, and savory notes, the flavour offers a perfect authentic chatpata kick for Indian masala lovers.

Market Share and Trends

Lay’s started with a blast in the market, capturing 40% of the market share by 2000. This share only rose in the coming years, to reach around 50% in 2005 (the statistics vary from report to report). However, the trend changed around the 2010s when Lay’s started losing market share to local companies. Lay’s is still a major player in the potato chips market, but the volume share fell to 33% in 2018-2019 and in FY23, the market share fell again to 30%.

Hence, lately, the overall trend has been a decline in market share only. In its full-year earnings report in 2023, the company stated that:

“Convenient foods unit volume declined 3.5%, primarily reflecting a high-single-digit decline in South Africa, partially offset by high-single-digit growth in the Middle East and low-single-digit growth in Pakistan. Additionally, India experienced a low-single-digit decline.”

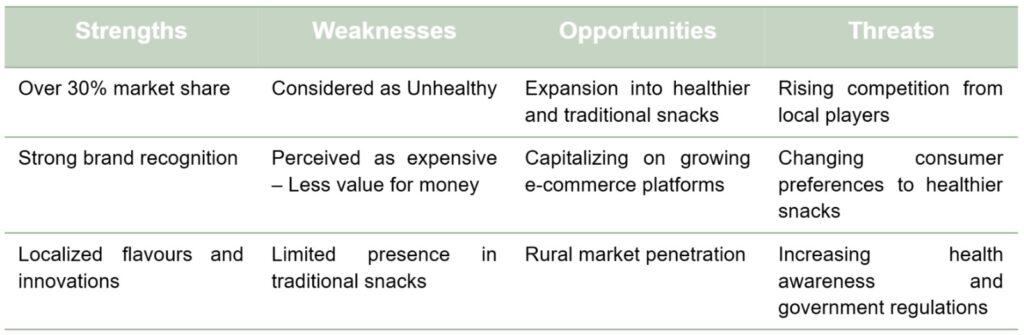

Current Market and Company Analysis

If we analyze the Strengths, Weaknesses, Opportunities, and Threats (SWOT) of the company, we can infer the following points:

According to a study conducted by the Ministry of Consumer Affairs, it was seen that Uncle Chipps ranked first when compared to other competitors on parameters such as consumer preference, value for money, and nutritional values. Lay’s along with Haldiram’s, Balaji, and Parle’s shared rank 2nd.

Today, the company faces competition from brands like:

- Haldiram: Renowned for its traditional Indian snacks, Haldiram’s has also ventured into the potato chips segment, providing flavors that cater to local tastes.

- Balaji: Originating from Gujarat, Balaji Wafers has expanded its reach across India, offering a variety of potato chips and traditional snacks.

- Parle: Parle’s products compete with Lay’s in the broader snacks and packaged food category, but its wafer chips are also favoured by consumers.

- ITC: Launched by ITC, Bingo! offers innovative flavors and has gained significant popularity among urban consumers.

- Prataap Snacks: Diamond chips catered by Prataap Snacks provide a diverse palate and a flavourful competition to Lay’s.

Reasons for Declining Market Share

The organized Indian snacks market is currently valued at ₹41,000 crore, with the potato chips segment accounting for ₹9,000 crore. Within this segment, PepsiCo’s Lay’s holds the largest market share, making it the dominant player. However, the decline in market share is not circumstantial or a fluctuation. The decline can be attributed to various factors.

The market forces of supply and demand dictate the market share of a product. Supply is controlled by the manufacturers, the distribution network, and the retailers. However, the demand is produced by the customers. Considering the manufacturing cost, manufacturer margin, and largely the same distribution network cost, the reasons are influenced mainly by two stakeholders, i.e., retailers and customers.

Retailers- Supply

While talking to retailers, we got to know that the major factors that influence a retailer’s decision to sell a product are:

Retailer Margin

In the case of potato chip brands, the retailer margin offered by Indian brands is much higher than what is offered by established foreign brands like Lay’s and Kurkure. A retailer said that Indian brands offer margins of around 20% or more. However, Lay’s offers a margin ranging from 10%-16%, reducing the retailer’s profitability per unit. To achieve the same level of profits with both local and foreign brands, the retailer has to sell more volume. Albeit, more sales volume is imperative due to the huge brand image of Lay’s, retailers are still moving toward local brands because of other factors at play.

Brand Image

Even though the lower retailer profit margin has somehow reduced the size of inventory of the chip giant at small and big retail shops, they can not exclude such a huge brand from their catalog. The name Lay’s is enough to make sales that can cover a significant part of the overall retailer profit in the segment for big and medium retail shops.

However, recently, the brand image has taken a hit because of the controversies around the name. These speculations have reduced the demand from the customer’s end.

Demand

Competitors are increasing the part of the pie covered due to the quality of products and the flavours offered, but even after that, the demand for Lay’s is there. Be it because of the advertising and the marketing tactics used (which cover a major part of the company’s spending), there is a demand for the brand across the country, influencing the retailers to sell the product.

Consumers- Demand

The demand for a product is directly influenced by the satisfaction or the value for money the product is providing. Considering the Indian market to be highly price sensitive, price elasticity of demand is high so value for money becomes a very important determinant of demand. Other than value for money, factors like quality of product, health impacts, brand image, product status, etc., play an equally important role which can be seen in the case of Lay’s as well.

The decline in demand can be attributed to the following reasons:

Value for Money

According to research, a ₹10 pack of salted potato chips from an Indian brand, Balaji’s contains 35 grams of chips, whereas PepsiCo Lay’s provides 23 grams for the identical price, the per gm cost of Lay’s, which comes out to be ₹0.43, is much higher than the per gm cost of Balaji’s which comes out to be ₹0.28. As Indian consumers are conscious spenders, lower value for money becomes the biggest demotivating factor for the middle and lower earning group of people.

Health Concerns

Consumers around the world have started prioritizing their health and noticing the ingredients of the products they are consuming. Thus, when Lay’s switched to cheap unhealthy palm oil in 2012, there was a huge consumer and critic outrage towards the move. Subsequently, reports showing that there was a significant amount of trans fat present in the marketed “0 Trans Fat” potato chips further aggravated consumer anger. Clarifications by top officials were not able to soothe the consumers. Using cheap palm oil, high levels of sugar, salt, preservatives, and frying the chips makes them high in calories and unsuitable for consumers.

Brand Image and Negative Publicity

The famous perception of Lay’s having “More Air, Less Chips” has hurt the brand image significantly. This perception has gained traction due to social media memes, customer complaints, and direct price comparisons with local brands like Balaji Wafers and ITC Bingo! Incidents like finding only 2 chips in a Rs. 5 packet made everyone wonder about the actual value for money rather than just the price per gram. Although, Lay’s advertisements show the packet overflowing with chips, the real-life experience was pointed out to be comically funny when the packet sometimes offers only 16g in a 30g packet.

Not only the chips-to-air ratio led to this deterioration of Lay’s brand image but the reports by health bloggers highlighting the use of palm oil further led to public distrust. An amalgamation of all the negative publicity news including the two mentioned has decreased the demand among Indian consumers.

Current Efforts and What can be Future Efforts

With all the controversy around Lay’s and the declining demand, the company must be looking for ways to grow the market share on top of sustaining the previous level. The company is trying to gain a hold on the Indian Consumers in different ways.

Recently, Pepsico has started trials to use a mix of sunflower oil and palmolein, a much healthier option compared to palm oil, in Lay’s chips. Palmolein is a liquid segment acquired through refining palm oil, both of which are sourced from the oil palm fruit.

Way Forward

As we are talking about Pepsico’s chips products and the Indian chips market, Pepsico can try to tailor-make flavours suitable for Indian tastes as small local brands are doing. Like Lay’s is available in other countries in flavours apart from those in India, efforts can be made to satisfy the huge Indian market.

While Pepsico has tied up with e-commerce platforms and Common Service Centres (CSCs) under the Ministry of Electronics and Information Technology, it can try to follow the traditional distribution system to make Lay’s available at local small kirana stores like local brands.

Moreover, the company should analyze retailer margins based on the cost of the products. The raw materials used, machinery used in production, advertising costs, etc., dictate the market price and retailer margin. However, if the company strategy fixes more on volume than profit per unit, then the high spending on marketing is justified, and the lower retailer profit can also work for the retailers.

Leave a Reply