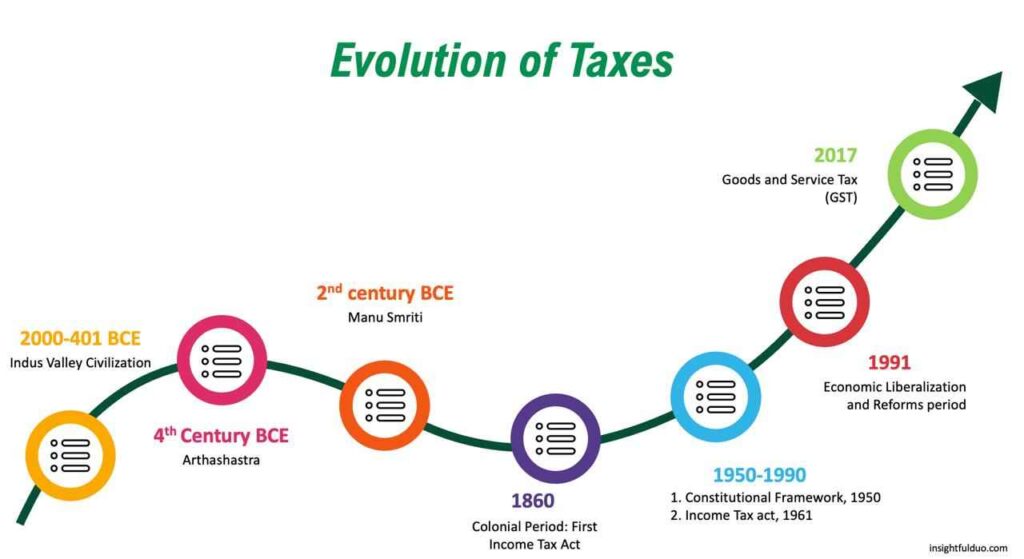

Discover the origins and evolution of the tax system in India, from ancient Vedic texts to modern GST. This is Part 1 of our Indian Tax Series for curious readers and responsible citizens.

Introduction

It is important to understand the evolution of taxation in India, since the moment we wake up until we sleep, taxes shape nearly every aspect of our daily lives. Whether it is paying for necessities like food, water, and electricity, using public infrastructure such as roads and transport, or indulging in luxury items like high-end cars, jewelry, or premium gadgets, taxes are ever-present.

In this series about the Indian Tax System, we will examine tax collection and expenditure and critically analyze whether and how Indian taxpayers reap the benefits.

In this first article, we will discuss taxes and how they evolved in India.

What are taxes? Where did they come from?

Typically, A tax is a mandatory financial charge or levy imposed by a government on individuals or organizations to generate revenue for funding public services and government activities. As it’s a charge, it is compulsory to be paid.

Historically, taxes have existed for thousands of years and have been essential to organized societies since ancient times. One of the earliest recorded instances of taxation dates back around 5,000 years to Ancient Egypt, where pharaohs appointed scribes or tax collectors to gather resources from the population. These taxes were primarily used to fund government operations and military campaigns. Since Egypt lacked coined currency at that time, taxes were often collected in kind, most notably, a levy of 20% on all grain harvests. Additionally, some sources indicate that taxes were also imposed in the form of corvée, a system of forced labor performed by peasants who could not afford to pay in goods. Nearly 2,000 years ago, the Roman Emperor Caesar Augustus issued a decree mandating that the whole world should be taxed; an event famously referenced in historical and religious texts.

However, the important question becomes who introduced the tax in India.

Who Introduced the Tax in India?

While taxation has existed globally since ancient times, the roots of India’s formal tax system can be traced back to early kingdoms and religious texts. During the Maurya Empire under the guidance of Kautilya (Chanakya), whose treatise Arthashastra outlined a detailed economic and administrative framework, one of the earliest systems of structured taxation in India was recorded. However, even before that, reference to taxes appears in the “Vedas, particularly the concept of bali” – a voluntary offering that gradually evolved into mandatory levies.

Later, during the colonial era, Sir James Wilson, a British civil servant, introduced the first formal Income Tax Act in 1860, primarily to cope with the financial strain following the revolt in 1857. This act laid the groundwork for income-based taxation in modern India.

In essence, tax in India was introduced through a combination of ancient customary practices, codified scriptures, and colonial formalization; each contributing layers to the system as we know it today.

Origin of the Indian Tax System

Indus Valley Civilization

Vedas, being the most ancient source of information about ancient India, written and circulated in the period between 2000-401 BCE, influenced all aspects of the life of the Indian population. Even the culture of tax obligations. Voluntary offerings to the rulers of the kingdoms, as well as sacrifices to the gods, were called bali. It was believed that the ruler would protect the country from enemies, and the gods would shield the people from drought and other disasters.

Ancient Indian literature mentions various taxes: bali, kara, and bhaga. At different times and in different sources, these words had different meanings.

Arthashastra

Kautilya’s Arthashastra, written in the 4th century BCE, suggested a planned and more elaborate tax system. He recommended:

- Bhaga, a standard tax rate of 1/6th of agricultural produce, arguing that this rate balanced state revenue needs with the taxpayers’ ability to pay

- Kara, a tax on trade and businesses.

- Shulka, a customs duty on imported goods.

- Danda, fines for breaking the laws.

The treatise also calls for a broad tax base with moderate rates, sector-specific taxation, and higher taxes on luxury or harmful goods. Kautilya stressed certainty in taxation-clear rules, fixed schedules, and transparent administration, to build trust and compliance. He also saw the king as a trustee of the land, with taxes being a means to fund public services and maintain order, not just a compulsory levy. He believed that the power of government depends upon the strength of its treasury. He also stated that “From the treasury, comes the power of the government, and the Earth whose ornament is the treasury, is acquired by means of the Treasury and Army.”

Manu Smriti

“It was only for the good of his subjects that he collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousand fold.”

– Kalidas in Raghuvansh eulogizing King Dilip.

Manu Smriti is an ancient Hindu text, and it lays down ethical and practical principles for taxation. It states that the taxes shouldn’t overburden the taxpayer and should be levied fairly (not too high, not too less). According to Manu Smriti:

- The merchant and artisan were taxed 20% of their earned income.

- Farmers paid 1/6 to 1/10 of their produce. The rate fluctuated with crop yield and economic conditions.

During the Colonial Period

The first Income Tax Act was enacted by Sir James Wilson, a British servant, around 1860. The income tax was then classified into four types, namely:

- Income from land property

- Income from salary and pension

- Income from securities

- Income from profession and trade

Over the years, this income tax was replaced by various acts like the License tax in 1867, the Certificate tax, and then the general income tax. Subsequently, the 1922 Act established a formal administrative structure and introduced the Central Board of Revenue and the Income Tax Department. The foundation of a proper system of administration was thus laid.

Post-Independence Period

Constitutional Framework (1950)

The Constitution of India, effective from January 26, 1950, divides taxation powers between the Union and State governments. Three lists (Union List, State List, and Concurrent List) have been provided to define power distribution among the States and the Union.

- Union List: Grants exclusive powers to the Parliament over subjects like income tax (except agricultural income), customs duties, and excise duties.

- State List: Empowers State legislatures to levy taxes on agricultural income, land revenue, and taxes on goods and passengers carried by road or inland waterways.

- Concurrent List: Allows both the Union and State governments to legislate on subjects like stamp duties and succession duties.

This framework ensures a clear demarcation of fiscal responsibilities, promoting cooperative federalism.

Income Tax Act, 1961

Before 1961, income tax in India was governed by the Income Tax Act of 1922, essentially a colonial-era legislation. The Income Tax Act, 1961, repealed the 1922 Act and incorporated all existing income tax laws into one structured legislation. It introduced clear definitions, comprehensive provisions, and a rationalized structure to avoid the ad hoc amendments that plagued the 1922 Act.

Defined five heads of income that are still used today:

- Income from salaries

- Income from house property

- Profits and gains of a business or profession

- Capital gains

- Income from other sources

Additionally, it introduced sections for deductions and exemptions, the concept of TDS, provisions for penalties, etc.

Economic Liberalization and Reforms Period

By mid-1991, India faced a severe balance-of-payments crisis. This dire situation necessitated urgent and comprehensive economic reforms. Some of the reforms were:

- Trade Liberalization: Import tariffs were significantly reduced, and non-tariff barriers were dismantled.

- Tax Reforms: The tax structure was overhauled to simplify procedures, broaden the tax base, and improve compliance. Notably, the introduction of Service Tax in 1994 expanded the indirect tax net to include the burgeoning services sector.

Apart from this, various tax slabs were revised, and an attempt was made to simplify the tax system.

Goods and Services Tax (GST), 2017

India introduced a unified indirect tax system that replaced a complex web of central and state-level indirect taxes. Some of the features are:

- Destination-based consumption tax

- Four main rates: 5%, 12%, 18%, and 28%

- Replaced VAT, excise, service tax, and more

- Dual model: CGST + SGST or IGST for inter-state

Conclusion

Being a responsible citizen, paying your taxes timely is important. However, knowing where the taxes come from and how they evolved is also an important part of being a responsible citizen. Hence, a brief introduction to what taxes are, how they were introduced in India, and how they evolved to reach the current state. In the next article of this series, we will look into the types of taxes in India.

Leave a Reply