India’s tax collection has evolved rapidly in recent years. In this third article of our Indian Tax Series, we break down how much tax India collects, analyze the trends in corporate and personal income tax, indirect tax performance, and what it reveals about our economy.

Tax forms a significant part of the government’s revenue. Tax collection in India is achieved from various channels handled by different departments and boards. Every government attempts to increase tax collection over the years. However, an analysis of the tax collected through each type and channel, the quantitative trend of the tax collected, and the contribution of different taxes to the overall tax is required. Hence, in this article, we will discuss how much tax India collects every year and some insights that can be drawn from the data.

In this series, we have discussed, so far, the evolution of the Indian Tax System and the types of taxes in India.

Key Sources of Revenue for Government

The government requires income to ensure the proper working of various public amenities, government institutions, welfare schemes, and the military. Every government regularly develops and maintains sources of money. Some of the key sources of revenue are:

- Tax Revenue: Direct and Indirect Tax

- Non-Tax Revenue: Government Institution Fee (hospital fee, education fee, passport fee, court fee, etc.), Profits by PSUs, Fines and Penalties, Licence and Permit Fee, Capital Receipts, Financial Aid, etc.

However, the scope of this article is limited to the tax revenue. The government decides how much money is to be collected from the public. Ideally, the quantity of public money that must be collected is determined by the need for public expenditure, the public’s ability to pay, interest payments, and the fiscal deficit target.

India’s Tax Collection Trend

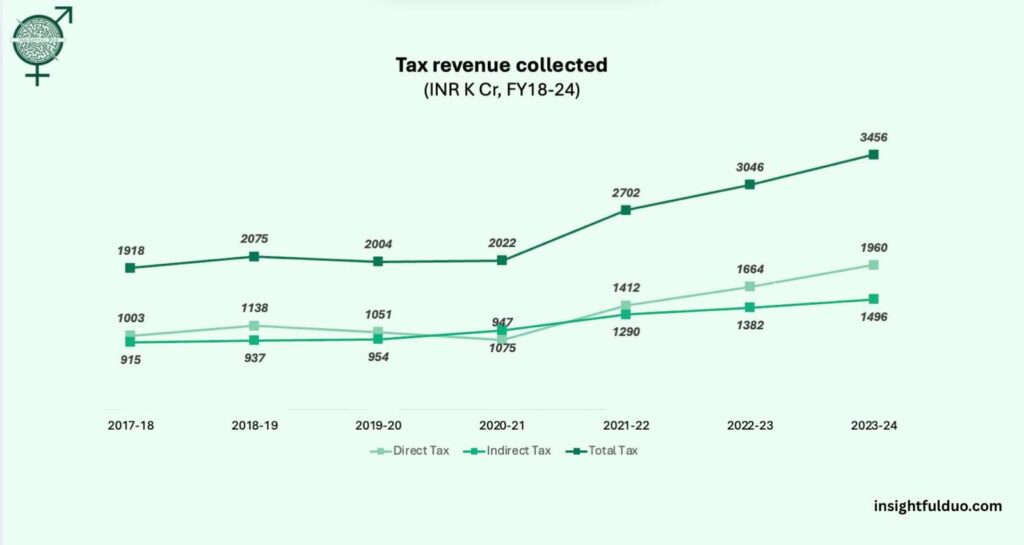

To understand how tax collection in India works and the trend in recent years requires examining both direct and indirect taxes, as well as the total tax collected.

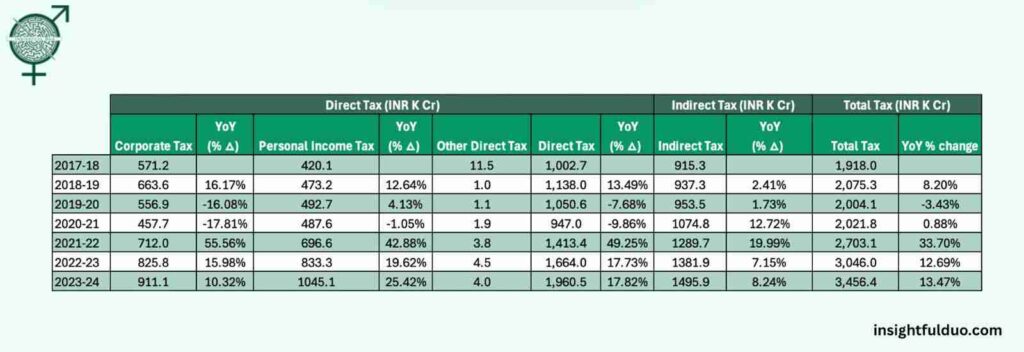

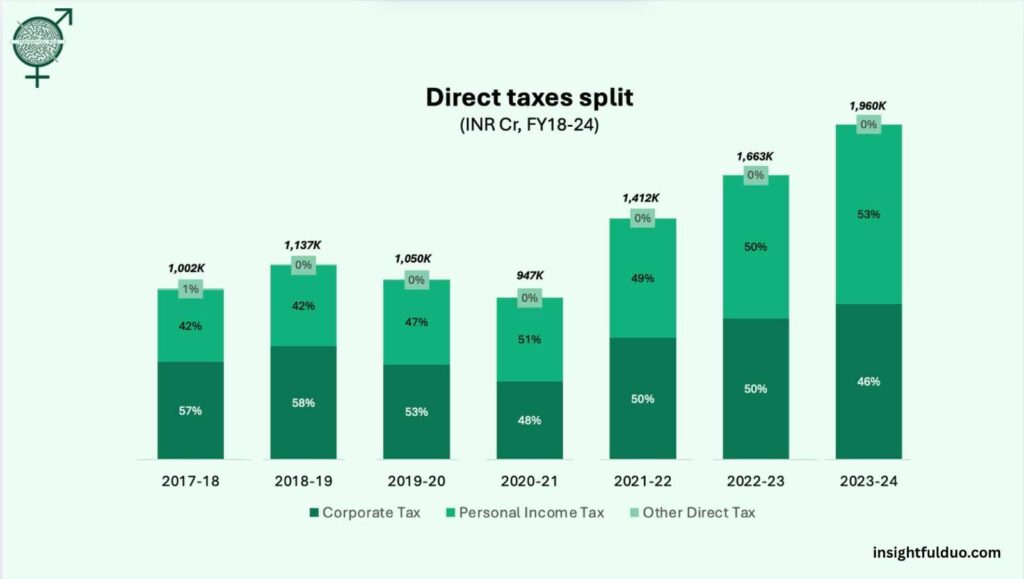

The corporate tax collection in India has seen its ups and downs. Corporate tax dipped after the 2019 corporate tax rate cut, from 30% to 20%. Subsequently, the dip continued due to the onset of the COVID-19 pandemic. However, pent-up demand from the pandemic boosted the corporate tax. Currently, the growth rate of corporate tax (~10% in FY 23-24) seems to be losing steam. For a developing country, if the GDP is growing at ~10%, then the corporate tax should ideally grow by ~11-13%.

On the other hand, personal income tax (PIT) was strained during the starting year, i.e., 2019-20. However, there is an uncanny resilience during the pandemic despite the massive job losses. In contrast, the past three years have seen huge growth in PIT, ranging from 20% to 43%.

It is important to note that, currently, PIT is contributing more to the overall direct tax than corporate tax. Additionally, the growth rate of PIT is greater than the growth rate of corporate tax.

Unlike direct tax, there was no negative growth in the indirect tax. During the initial years of GST implementation and the pandemic, the growth rate of indirect tax was minimal. However, post-pandemic growth rates picked up and soared to 20%. Regardless of the boost, the growth in the past two years has been moderate at around 7-8%, which is quite low.

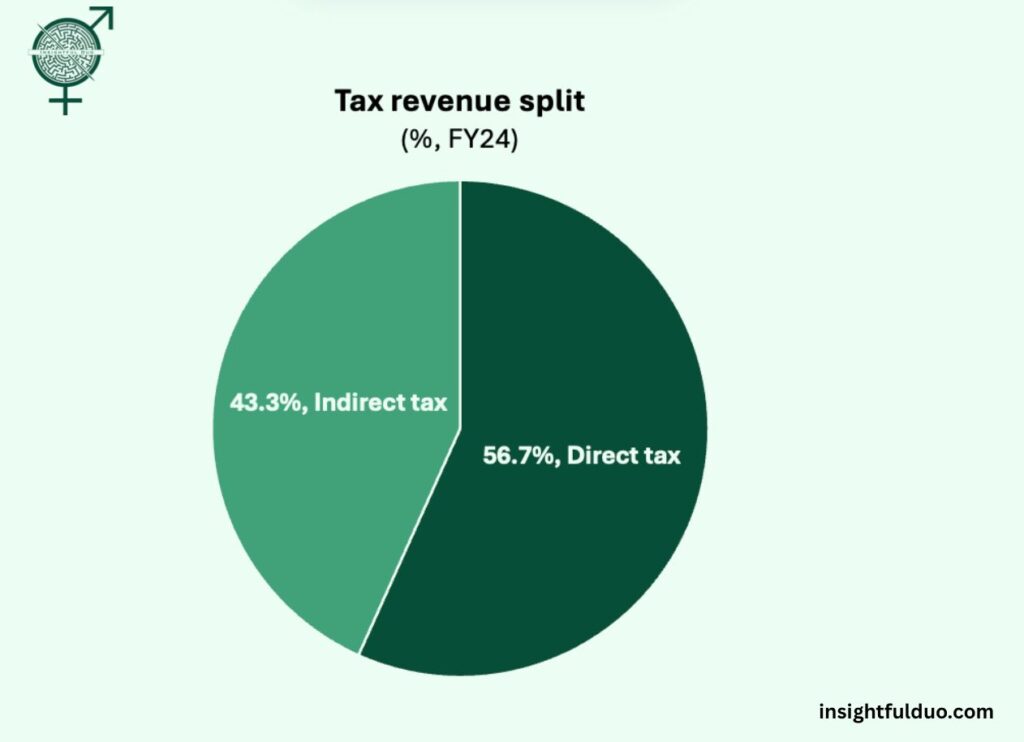

Finally, the pie chart illustrates that, currently, direct taxes cover a larger area of the pie as compared to the indirect taxes. This imbalance between direct and indirect tax collection has been increasing over the past few years.

What does the data say?

We have analyzed the current trend of taxes from all aspects, but what does that mean? Well, let’s see.

Post-pandemic pent-up demand boosting corporate tax was positive; however, the growth rate settling to a lower level of 10% might be an issue. Although the FY24 profit growth rates reported by companies were low, this may have induced the lower growth of corporate tax.

On the other hand, the resilience of the PIT during COVID-19 is concerning. It might imply that the salaried class (like government employees) carries all the burden of the PIT. It means that the other individuals (owning businesses or LLPs) are contributing less to PIT. Nonetheless, a sudden stagnant PIT during an economic shakedown and massive job loss is uncanny. Subsequently, the steep rise in the PIT either indicates better compliance or a surge in high-income jobs.

However, the cause of concern is not the growth of PIT. A sudden sharp increase in PIT means that the individuals are paying more taxes. India, whose middle class is working in MNCs and tech companies, should have a proportionate increase in the corporate tax as well, which is not observed.

The over-reliance on PIT, than the corporate tax, is unsustainable without a corresponding rise in job creation and income equity, which in India is again linked to company profits and corporate taxes. Regardless, high PIT growth and moderate GDP indicate a disproportionate tax load on individuals. This, along with some other factors, likely became the reason for the recent tax slab changes by the Finance Minister of India. This imbalance, along with the muted profits from the corporate also justify the recent rate cuts by the RBI.

Nevertheless, the causes of concern are not over yet. Analyzing indirect tax data, there is a ~12% increase in Indirect tax revenue during the pandemic year, i.e., 2020-2021. Although the consumption of goods and services decreased, leading to a decrease in GST revenue, it was the time when there was a steep surge in excise duty on fuel, due to the global situation, which became the reason behind the increase in indirect tax. The rise in excise duties was never fully reversed. This all questions the actual reasons leading to growth in indirect tax revenue.

Considering simplification of the indirect tax structure and increasing government revenue through an increase in tax compliance was the agenda of introducing GST, the data shows another picture.

Additionally, growth slower than nominal GDP growth in indirect tax from 2022 to 2024 raises concerns. It indicates weakening household consumption and an underreported informal economy.

However, direct tax is contributing more than indirect tax to the overall tax, which is a good indicator. Since direct taxes are progressive and based on income or profit, it is good to have a higher tax ratio from direct taxes.

Conclusion

The recent trend of tax collection has a story to tell. Tax collection trends provide relief as well as reasons for worry, from the boost in corporate taxes after the pandemic to the low growth rates during the recent economic slowdown, from the out-of-the-ordinary resilience of PIT during the pandemic to the sharp growth, from reliance on corporate tax to over-reliance on PIT, from sudden GST compliance rise to a possibility of underreported informal economy, from low contribution of direct taxes to overall tax to higher contribution of direct taxes.

However, some of the concerns are the low growth of corporate tax revenue in recent years, the resilience of PIT during the pandemic, the high growth rates of PIT in recent years along with low profit growth rates of companies, and the slow growth of the indirect taxes.

On the other hand, there are a few reliefs as well. The consistent growth rates and higher contribution of direct tax to the overall tax revenue are good macroeconomic indicators.

In summary, a growing PIT share doesn’t negate the benefits of a rising direct tax base — but the ideal scenario is growth across both, PIT and corporate tax, with balanced contributions based on capacity.

Leave a Reply