Explore the different types of taxes in India with this second part of our tax series. Understand how direct and indirect taxes work, their subcategories, and their impact on individuals and businesses.

It is crucial to understand the types of taxes in India, since the moment we wake up until we sleep, taxes shape nearly every aspect of our daily lives. To analyze the government’s competence and adequacy, we generally analyze the economic aspects of the nation and taxes form a significant part of them.

In this series on the Indian Tax System, we are examining the evolution of taxation in India, including tax collection and expenditure, and whether and how Indian taxpayers benefit from it.

In this second article of the series, we will discuss the different types of taxes collected.

Types of Taxes in India

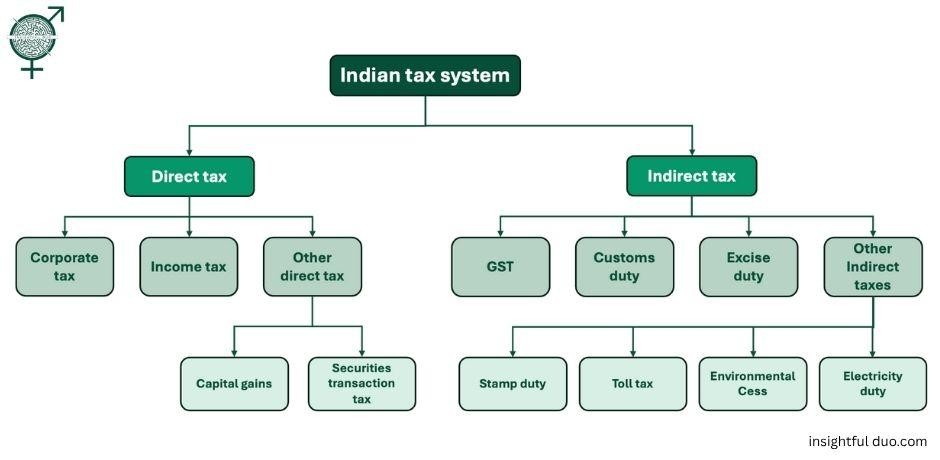

Starting from a rather unplanned and brief tax system, Indian taxes have evolved to simplify the complex net of taxes. The tax system can be divided into two broad kinds of taxes, namely:

- Direct Taxes: Taxes paid directly by individuals, entities (Hindu Undivided Families (HUFs), Associations Of Persons (AOPs), companies), or partnership firms to the government.

- Indirect Taxes: Taxes collected by an intermediary (such as a retail store) from the person who bears the ultimate economic burden of the tax (such as the customer).

Types of Direct Taxes

In Direct Tax, there are no intermediaries, and it can not be shifted to another party when we talk about direct taxes. These are collected directly by the Central Board of Direct Taxes (CBDT) under the Department of Revenue, Ministry of Finance. Direct taxes are a source of revenue for the Central government only. The types of direct taxes are as follows:

Corporate tax

Corporate Tax is a tax charged on the income earned by any company operating in India and registered under the Companies (Amendment) Act, 2019, whether domestic or foreign, private or public. It is governed by the Indian Tax Act, 1961, which is amended annually in the Finance Act, as part of the Union Budget. An individual pays taxes according to the tax slabs mentioned in the Finance Act of that year.

Corporate tax is levied on the net profit of the company after allowing for the expenses, depreciation, and incentives under the Income Tax Act. The tax rate is different for domestic and foreign companies. There is an additional surcharge and cess levied depending on the company’s income.

However, under direct tax, there are other provisions and deductions as well. One such important provision is MAT.

Minimum alternate tax (MAT)

Many companies manage to escape their tax liabilities by claiming various deductions, exemptions, or using credits or loopholes in the tax system. So, the concept of Minimum Alternate Tax (MAT) was introduced to earn taxes from these companies. Now, a company is supposed to pay either the Corporate tax or MAT, whichever is higher.

Income tax

Income tax is a tax imposed on individuals, Hindu Undivided Families (HUFs), partnerships, and Associations of Persons (AoPs). The slabs and guidelines for this tax are also contained in the Finance Act, a part of the annual Union Budget.

In the 2020 budget, the government introduced the New Tax Regime to simplify compliance and reduce dependence on tax-saving instruments. Hence, now the old regime (with deductions and higher rates) and the new regime (without deductions and lower rates) are two personal income tax systems offered to individual taxpayers of India.

Key characteristics:

- Progressive in nature, meaning the tax rate increases as the taxpayer’s income increases

- Ensures that high-earning taxpayers pay more taxes and low-earning taxpayers pay either lower taxes or no taxes, achieved by structuring distinct tax slabs for different levels of income.

- Require filing of returns, e.g., Income Tax Return (ITR).

To avoid tax evasion, there is an additional provision called AMT.

Alternate Minimum Tax (AMT)

This provision is the same as MAT, except for the applicability. This tax doesn’t apply to companies, but to individuals and entities (other than companies).

Other Direct Taxes

Capital Gains Tax

These are levied on profits earned from selling capital assets. A capital asset is officially defined as a property of any kind held by an assessee. It includes land, buildings, bonds, cars, stocks, bonds, goodwill, brand name, etc. It doesn’t include stock in trade, raw materials, personal use items like clothes, furniture, household goods, etc., and agricultural land in rural areas (i.e., outside specified municipal limits).

Capital gains can be classified into two types:

- Short-term capital gain is earned on an asset held for a short period (e.g., a period of less than 12 or 24 months)

- Long-term capital gain is earned on an asset held longer than the specified short-term period

Tax rates vary based on the type of asset and holding period.

Securities Transaction Tax (STT)

It is a tax levied on every purchase and sale of securities listed on recognized stock exchanges (NSE or BSE) in India. Securities are mainly financial assets such as shares, bonds, mutual funds, etc.

The purpose of introducing STT is to curb the tax evasion on capital gains, as it is charged at source.

Types of Indirect Taxes

An indirect tax is a tax whose burden can be shifted to someone else. In this case, the taxpayer acts as an intermediary, collecting the tax from the ultimate consumer before paying it to the government.

Before 2017, India had a complex web of indirect taxes. To streamline this, the government introduced the Goods and Services Tax (GST). Along with GST, other forms of taxes comprise indirect taxes.

Goods and Services Tax (GST)

Goods and Services Tax (GST) is a comprehensive, multistage, destination-based tax that is levied on each value addition and administered by the GST Council. Even if a product undergoes minimal change, if it results in a distinct output or service, GST applies.

One of the key features of GST is its credit mechanism known as Input Tax Credit (ITC), allowing the transfer of tax credit across the supply chain. This prevents tax cascading and ensures only the value added at each stage is taxed. However, the final customer, who does not get ITC, bears the full cost.

GST is a dual model with:

- Central GST (CGST): levied by the Central Government.

- State GST (SGST): levied by the respective State Governments.

However, it also consists of Integrated GST (IGST), which is levied and collected by the Central Government is applicable on inter-state transactions of goods and services, and Union Territory GST (UTGST), which is again levied and collected by the Central Government is applicable on inter-union territory transactions of goods and services.

There are different GST tax slabs based on the goods and services provided. Luxury goods are taxed at a higher rate, and essential goods are taxed at a lower rate.

However, items like petroleum products, alcoholic liquor for human consumption, and electricity are currently outside the GST scope.

Customs Duty

A tax levied on the import and export of goods, administered by the Central Board of Indirect Taxes and Customs (CBIC). It is governed under the Customs Acts, 1962. The major types of customs duties are:

- Basic Customs Duty: A duty imposed on the value of the goods at a specific rate on an ad-valorem basis.

- Countervailing Duty (CVD): A duty imposed by the Central Government when a country pays a subsidy to exporters who are exporting goods to India.

- Safeguard Duty: A duty imposed to safeguard the interest of our local domestic industries.

- Anti-Dumping Duty: A duty imposed to protect domestic industries if the goods are being sold at less than their normal value

Excise Duty

Excise duty is largely abolished post-GST except for a few items, like petroleum products, alcohol for human consumption, tobacco, etc.

Other Indirect Taxes

Some other indirect taxes are:

- Stamp Duty and Registration Fee: Tax levied by the State governments on legal documents, property transfers, agreements, etc.

- Toll Tax: A Tax levied on highways

- Environmental Cess: A tax levied on coal and polluting industries

- Electricity Duty: A tax levied on power consumption.

Conclusion

To analyze the economic parameters better, we need an overview of the types of taxes in India. Hence, major forms of taxes, along with their important features and provisions, were covered. In the next article of this series, we will discuss the collection of taxes and their trend during the past few years.

Leave a Reply