Curious about what is PSU in India? Learn about PSU in India, their types, and categories like Maharatna, Navratna, and Miniratna. Explore how PSUs are classified under different schedules and their importance in India’s economic framework.

India has been an agrarian nation since its start. After Independence in 1947, the need of the hour was economic development. However, it was not just economic development but sustainable economic development. Stemming from this requirement and the need to substitute imports, government intervention and regulation of the economy were necessitated. Hence, state-led entities appeared especially in sectors where private investment was once scarce or risky.

Hence, it becomes important to understand what is PSU, its history, types of PSUs, and schedules of PSUs, given their crucial role in the country’s economic growth and their significant market share.

What is PSU?

According to a response from the Ministry of Corporate Affairs to Parliament,

“The term Public Sector Undertaking (PSU) is not defined under the Companies Act, 2013 (the Act).”

It goes on to state that:

However, as per Section 2(45) of the Act, Government company is defined as “Government company means any company in which not less than fifty-one per cent of the paid-up share capital is held by the Central Government, or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments and includes a company which is a subsidiary company of such a government company”.

History of PSUs in India

When India gained independence, the economy was primarily dependent on agriculture. During the British Raj, farming was left to the private sector, while other sectors like tea processing, railways, steel mills, and a few others were largely owned by private individuals.

India had limited investment in public facilities like education and healthcare. This not only represented the underdevelopment in the nation but also the hindrance to building its industrial base. This became a key justification for expanding both the public sector and PSUs.

Post-independence, for economic development, rapid industrialisation was favoured. Based on a strategy of government intervention and regulation of the economy, the first Industrial Policy Resolution was announced in 1948. Later in 1951, the first five-year plan was proposed along with the Industrial (Development and Regulation) Act, aimed at empowering the government to take steps to regulate industry.

The second five-year plan (1956) emphasized heavy industries and import stabilization. The major PSU in India, like SAIL, BHEL, ONGC, etc., were also established. The second five-year plan was based on the Industrial Policy Resolution of 1956, which divided industries into three categories (state-exclusive, mixed, and open to private).

Henceforth two-decade-long dominance of PSUs started. They dominated steel, banking, power, telecom, transport, etc. However, with the economic crisis came the period of disinvestment, leading us to the present day.

Types of PSUs

PSU in India are categorized based on various parameters such as ownership, sector, formation or registration, operational level, status, and level of autonomy.

Since the classification based on ownership is fairly straightforward, we will discuss the classifications that are not self-explanatory.

Ownership-based Classification

Central PSUs (CPSUs)

Central Public Sector Enterprises (CPSEs) or Central Public Sector Undertakings (PSUs) refer to those Government companies and Statutory Corporations set up under different Statutes of the Parliament wherein more than 50% of the equity shares are held by the Central Government.

State PSUs (SPSUs)

State Public Sector Undertakings (PSUs) refer to those Government companies and Statutory Corporations set up under different Statutes of the Parliament wherein more than 50% of the equity shares are held by the State Government.

Statutory Corporations

Statutory corporations are government establishments brought into existence by a Special Act of Parliament. This is a body corporate created by the legislature with defined powers and functions, and is financially independent with clear control over a specified area or a particular type of commercial activity. Statutory corporations, therefore, have the power of the government and the considerable amount of operating flexibility of private enterprises.

Performance-based Classification

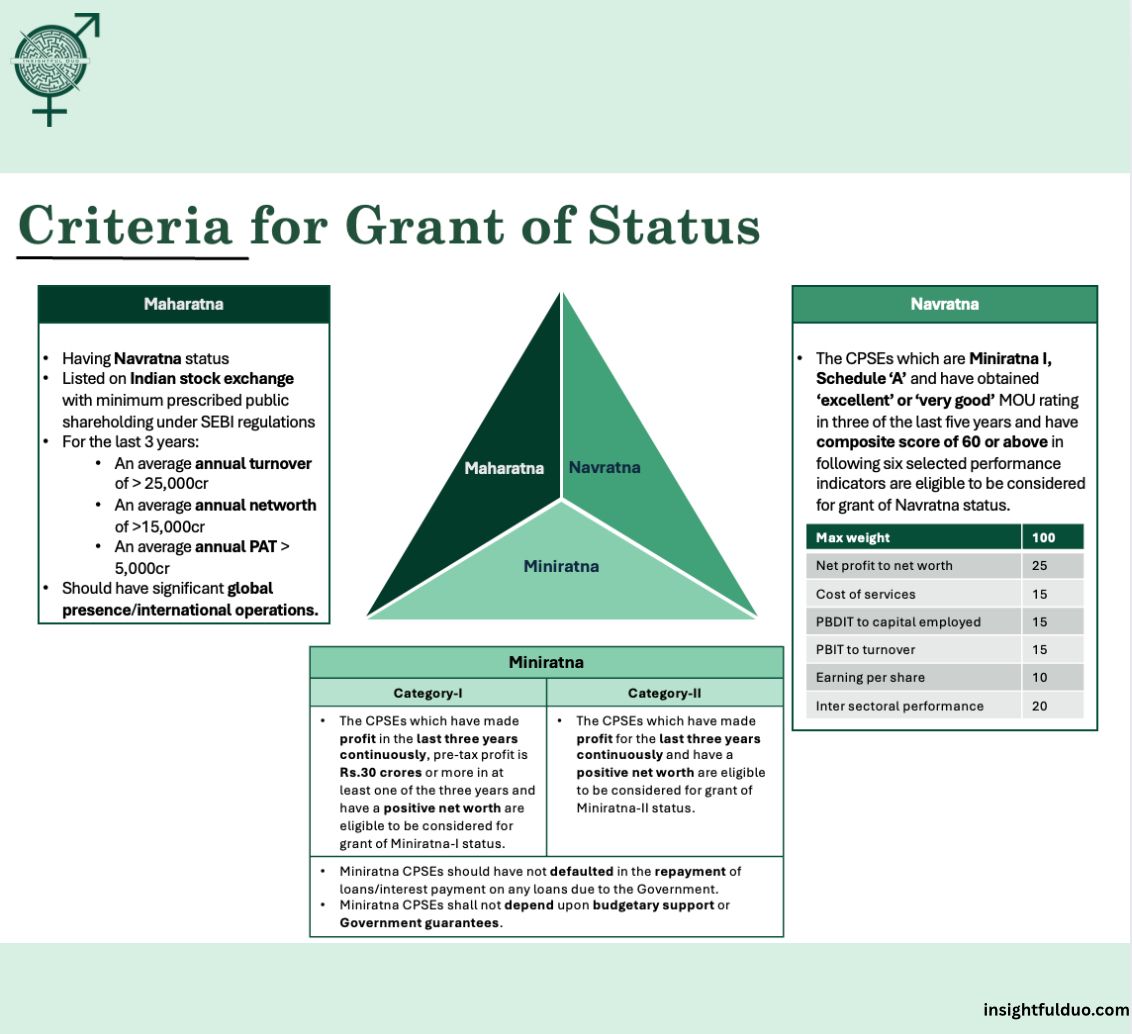

The Department of Public Enterprises (DPE) issues official guidelines defining Ratna Categories, i.e., Maharatna, Navratan, and Miniratan, for Central Public Sector Enterprises (CPSEs). The guidelines are depicted below:

There are governance and operational autonomy differences between Maharatna, Navratna, and Miniratna PSUs. These differences determine the extent to which PSU can make decisions without prior government approval, especially for investments, joint ventures, or organisational restructuring.

The operational differences are:

Maharatna

- Highest level of autonomy

- Can invest up to ₹5,000 crore or 15% of their net worth (whichever is lower) on a single project without seeking government approval

- Can make decisions regarding: Mergers and acquisitions, restructuring and capital expenditure, and foreign investments and joint ventures

- To raise debt from the domestic capital markets and from the international market, the latter being subject to the approval of the RBI/Department of Economic Affairs, as may be required, and should be obtained through the administrative Ministry.

- Allowed to structure their board-level committees

- Listed on the Indian Stock Exchange, with a minimum prescribed public shareholding under SEBI regulations

Navratna

- Can invest up to ₹1,000 crore or 15% of their net worth (whichever is lower) on a single project without seeking government approval

- Greater freedom for: strategic alliances and tech collaborations, domestic acquisitions

- Still need government approval for large foreign acquisitions, structural changes, or disinvestment

- Allowed to form their board committees, like the audit and HR Committees

Miniratna

Category I

- Can invest up to ₹500 crore or equal to their net worth (whichever is lower) without government approval

- Limited autonomy in: capital expenditure, technological upgradation

- Require government approval for joint ventures abroad

Category II

- Can invest up to ₹250 crore or 50% of their net worth (whichever is lower)

- Least autonomy among categories

- Typically smaller in size and operations

- Stricter oversight by the administrative ministries

Schedules of PSUs

This classification system was aimed at providing relativity between the compensation structures of Board-level executives of CPSEs. The categorization of CPSEs into 4 Schedules, namely A, B, C & D, was initially made by a Committee of Secretaries, on the basis of their importance to the economy and the complexities of problems. These categories are based on quantitative criteria (like investment, capital employed, sales, profits, number of units/employees) and qualitative factors (such as national importance, technology complexity, expansion potential, strategic relevance). These schedules are used to determine the pay scale, seniority, and eligibility for board-level positions in CPSEs.

The 4 types of schedules are:

Schedule A

It contains all the large and most strategically important CPEs. These PSUs are active in sectors like oil & gas, power, steel, mining, and heavy industries. Most of these are profit-making and should be able to pay the proposed compensation package without any problem.

Schedule B and C

It contains relatively smaller companies and some perennially sick companies. The committee proposes slightly lower scales of pay for these companies, so that the weaker among these companies are not overburdened with the wage bill. It often contains region- or sector-specific companies, with fewer operational units

Schedule D

It covers entities under closure, liquidation, or non-operational status, often loss-making. The Committee suggests that the Government may consider withdrawing from such small companies, except those that have been set up for implementing some specific Government programmes.

Conclusion

Public Sector Undertakings (PSUs) have been a cornerstone of India’s economic journey since Independence—driving industrial growth, creating employment, and ensuring strategic control in critical sectors. Understanding what is PSU, along with its types, categories like Maharatna, Navratna, and Miniratna, and the schedules that define their governance and pay structure, offers deeper insight into how these entities operate within India’s mixed economy.

Leave a Reply